The US LNG industry is facing a harsh reality check. Trump’s ban on Chinese ships has effectively closed off America’s third-largest market. Exports had surged dramatically since 2016, positioning the US as the global LNG leader. Now? Plants that were supposed to double capacity by 2028 are in jeopardy. Rising domestic prices, global decarbonization efforts, and trade tensions create a perfect storm. The once-celebrated American success story suddenly looks much shakier.

America’s liquefied natural gas juggernaut is slamming into a wall. After years of meteoric growth that transformed the U.S. into the world’s largest LNG supplier, the industry now faces a perfect storm of challenges. And boy, is it getting ugly.

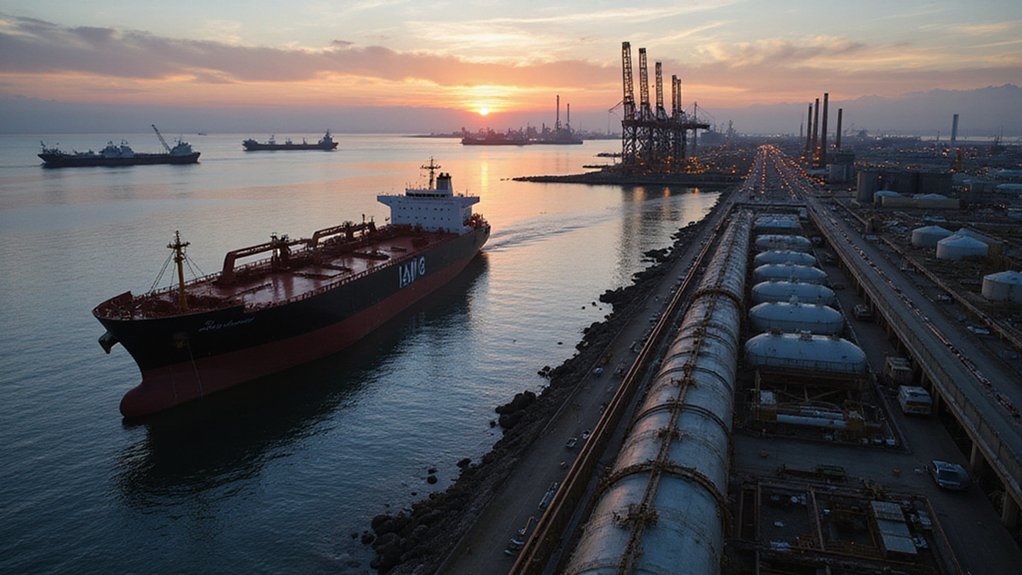

Since 2016, when the first major facility in the lower 48 states fired up, U.S. LNG exports have climbed every single year. The country leapfrogged Australia and Qatar in the global rankings. Talk about an American success story.

Facilities like Plaquemines LNG Phase 2 and Golden Pass LNG were set to nearly double export capacity by 2028. Everything was going great. Until it wasn’t.

The escalating U.S.-China trade war just threw a massive wrench into the works. China has completely suspended LNG imports from America. Let that sink in. The country that once gobbled up 15% of U.S. exports has simply walked away. Ouch.

Making matters worse, natural gas prices are expected to skyrocket. The Henry Hub spot price could nearly double from 2024 to 2025, averaging around $4.20/MMBtu. Higher exports, higher prices — it’s basic economics.

But now export forecasts are all over the place. The new facilities represent 19% of incremental export capacity planned for 2025-2026. That’s billions in investments now facing serious questions.

Who’s going to buy all this gas if China’s out of the picture? Nobody seems to have a good answer.

Meanwhile, the global push to decarbonize isn’t helping matters. More countries are rethinking their long-term commitments to fossil fuels, including LNG. US exports have surged from 0.5 billion ft³/d in 2016 to 11.9 billion ft³/d in 2024, but this growth trajectory is now uncertain. This rapid expansion has come with significant costs, as average U.S. households may soon pay $122 more annually for heating and electricity due to increased exports. Regulatory shifts under different administrations add another layer of uncertainty.

The industry now stares down a brutal dilemma: continue massive expansion plans without one of its biggest customers, or pump the brakes and risk losing market share to competitors like Qatar. The loss of Chinese buyers jeopardizes nearly a third of future project volumes, making it increasingly difficult to secure financing for proposed terminals.

Either way, the glory days of unfettered growth appear to be over. America’s LNG dream just got a harsh reality check.

References

- https://mercercapital.com/energyvaluationinsights/domestic-production/u-s-lng-in-2025/

- https://www.eia.gov/todayinenergy/detail.php?id=64884

- https://cleantechnica.com/2025/04/18/china-walks-away-u-s-lng-expansion-plans-unravel-as-trade-war-escalates/

- https://www.lngindustry.com/special-reports/04042025/how-will-the-start-up-timing-of-new-us-lng-export-facilities-affect-the-eias-forecast/

- https://shalemag.com/us-lng-projects/