OPEC+ announced plans to increase oil production by 411,000 barrels daily starting May 2025, despite Brent crude prices falling to four-year lows below $60 per barrel. The decision combines three monthly increments and involves eight major oil-producing nations including Saudi Arabia and Russia. Officials cite “healthy market fundamentals” as justification for the shift. Experts project prices will stabilize between $75-85 by June. This strategic recalibration follows extended production cuts through March 2025.

Several major oil-producing nations have agreed to boost their output starting May 2025. The OPEC+ alliance announced it will increase oil production by 411,000 barrels per day. This increase combines three monthly production increments into one adjustment. Eight countries will participate in the production boost, including Saudi Arabia, Russia, Iraq, UAE, Kuwait, Kazakhstan, Algeria, and Oman.

OPEC+ cited “continuing healthy market fundamentals and a positive market outlook” for this decision. However, the group noted that increases may be paused or reversed if market conditions change. Each country received specific production targets for May 2025. Saudi Arabia must reach 9,200,000 barrels daily, while Russia’s target is 9,083,000 barrels. Low oil inventories suggest the market remains in a healthy state despite current price challenges. The actual increase in production might be lower than the announced target, as OPEC+ compliance has varied historically among member nations.

The decision marks a significant shift in strategy. OPEC+ producers had previously agreed to voluntary output cuts of 2.2 million barrels daily for the first quarter of 2024. These cuts were extended through March 2025. Just recently, in March 2025, producers agreed to start gradually reversing these cuts over an 18-month period from April 2025 to September 2026.

OPEC+ pivots from production limits to gradual increases after extending cuts through Q1 2024 and into 2025.

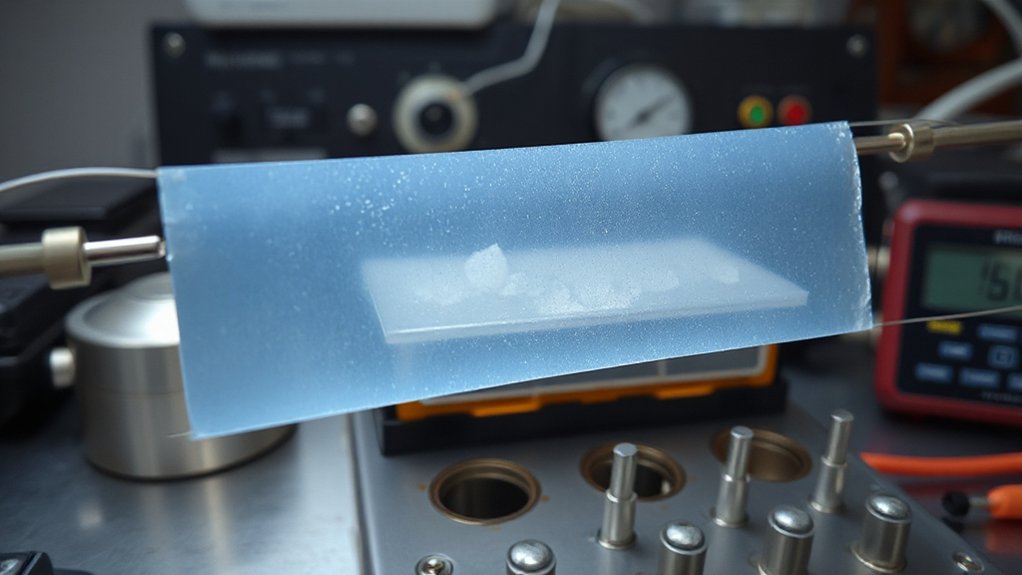

This production increase comes at a challenging time for oil markets. Brent crude prices dropped to a four-year low below $60 per barrel in April 2025. Experts project prices might stabilize between $75-85 per barrel by June. The shift toward geothermal energy could further reduce future oil demand as countries seek more reliable and environmentally friendly energy sources. The group’s spare capacity now stands at 5.7 million barrels daily, down from 7.2 million in 2023.

OPEC+ has also strengthened its compliance requirements. Member countries must fully compensate for any overproduction since January 2024. The eight participating nations will meet again on June 1, 2025, to decide on July production levels.

The production boost represents a strategic recalibration aimed at reducing excess spare capacity within the alliance. It also puts pressure on underperforming nations to meet their targets. Despite increasing production, OPEC+ maintains its commitment to supporting oil market stability with what it calls “gradual and flexible” adjustments.

References

- https://www.opec.org/pr-detail/243563-03-may-2025.html

- https://www.iea.org/reports/oil-market-report-april-2025

- https://www.enerdata.net/publications/daily-energy-news/opec-increase-oil-production.html

- https://www.opec.org/pr-detail/557-03-april-2025.html

- https://www.ainvest.com/news/opec-accelerates-oil-output-hike-strategic-shift-market-implications-2505/