While most people think of tech giants and coal plants as unlikely partners, a surprising trend is emerging across the energy terrain. As coal plants retire, tech companies are showing increased interest in these sites. They’re attracted to the valuable electrical infrastructure that can power their growing data centers.

Coal plant locations offer ready-made power distribution systems that AI operations desperately need. The existing transmission connections make these sites particularly attractive for power-intensive computing. This interest comes at a time when coal remains the world’s largest source of power generation, though its share in the electricity mix has dropped to 35%, the lowest since 1974.

Coal’s legacy infrastructure provides AI’s hungry systems the grid connections they crave, even as coal’s global dominance wanes.

Global coal demand grew by 1.2% in 2024, adding 67 million tonnes of coal equivalent. This growth has slowed since the post-pandemic rebound of 2021. The electricity sector continues to drive this demand, accounting for two-thirds of global consumption. Record temperatures in China and India pushed up electricity demand for cooling, further increasing coal use.

Tech companies have dominated energy deal activity, representing 84% of the US market. The industry sector now accounts for 33% of total US energy consumption. AI infrastructure requires substantial electrical capacity beyond typical commercial needs. This growing demand conflicts with the expert recommendation that 60-80% of electricity should come from renewable sources by 2035. Machine learning model training creates sustained high-load demands, and cooling requirements add significant energy overhead.

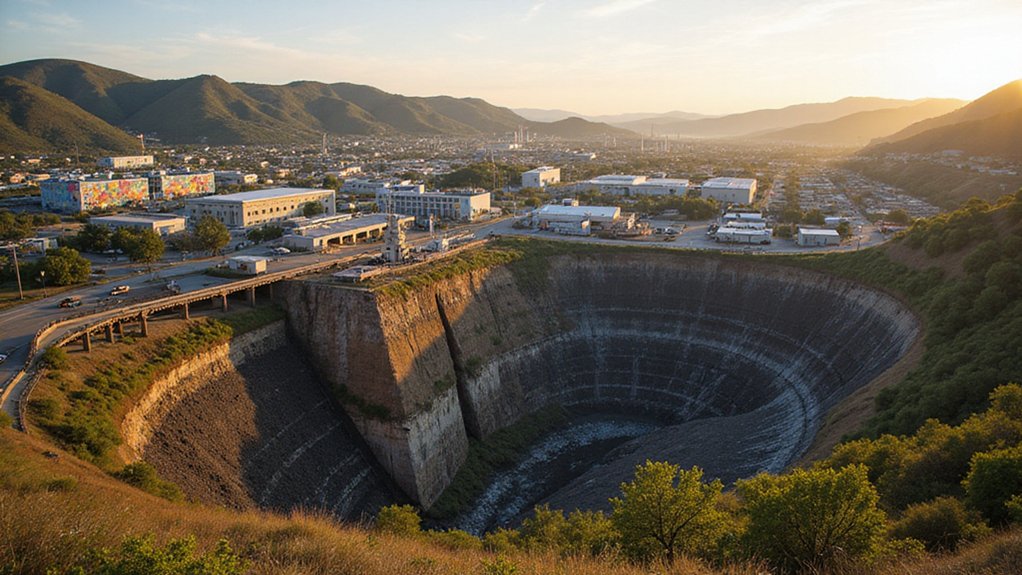

By repurposing retired coal plants, tech giants can meet their power needs while helping maintain local jobs. These sites shift from traditional energy production to supporting the digital economy. The conversion projects represent a bridge between coal’s declining role and technology’s rising power requirements.

This trend highlights an unexpected connection between old and new energy paradigms. Advanced economies have seen their coal demand halve since peaking in 2007, creating opportunities for repurposing infrastructure. As AI and cloud computing drive increased demand for electricity, coal plant infrastructure offers a ready solution. The high-voltage grid connections at these former coal sites provide tremendous value for new power projects looking to connect quickly to the electrical grid. While global coal demand is expected to remain flat through 2025, its unlikely partnership with tech may reshape how we think about energy shifts.

References

- https://finance-commerce.com/2025/04/coal-plants-ai-power-demand-energy-reuse/

- https://www.iea.org/reports/global-energy-review-2025/coal

- https://globalenergymonitor.org/projects/global-coal-plant-tracker/

- https://bcse.org/market-trends/2025-key-trends/

- https://www.iea.org/news/global-coal-demand-is-set-to-remain-broadly-flat-through-2025