Nearly every Australian gas consumer is feeling the pinch as the nation’s gas market remains in turmoil. The numbers tell a brutal story. Wholesale prices have tripled since LNG exports began in 2015, skyrocketing from a comfortable $3.33/GJ to an eye-watering $9.67/GJ average. Ouch.

The current situation isn’t pretty. Victorian spot prices hit $10.51/GJ by February 2025, while east coast wholesale prices hover around $12.20/GJ. That’s 3.7 times what Australians paid before export terminals fired up. Remember those days? Neither does your wallet.

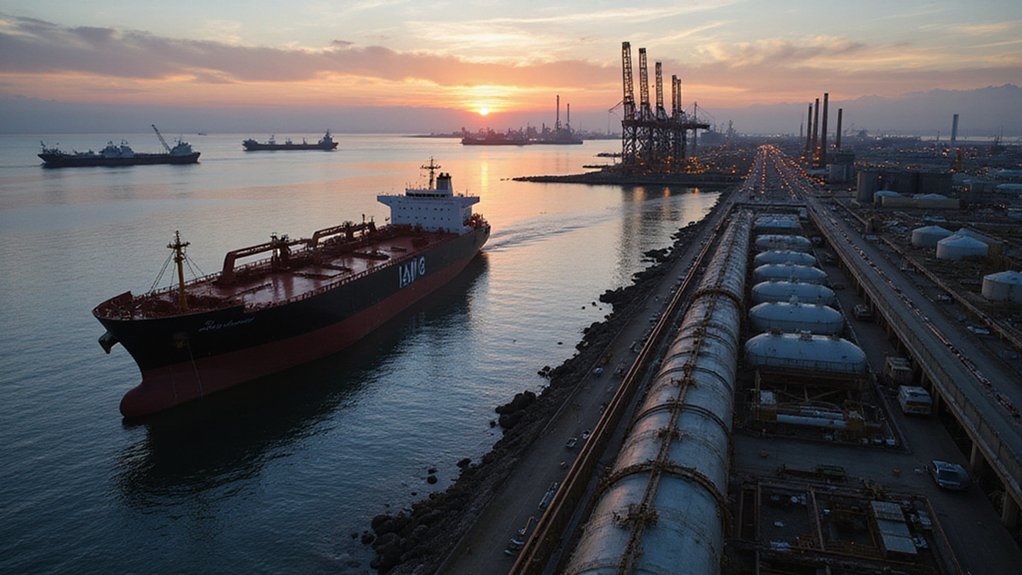

Gas prices have skyrocketed to painful heights, making Australians nostalgic for the days before exports changed everything.

It’s not all doom and gloom, though. Prices offered to retailers for 2025 supply have dropped 10% to $13.34/GJ. Retailer offers to commercial users are down 7% to $14.34/GJ. Small mercies.

Demand is tanking as consumers flee from shocking bills. Total gas consumption in eastern Australia has plummeted 29% since 2012-13. Victoria’s manufacturing sector alone slashed gas use by 33%. No surprise there – who can afford this stuff anymore?

The most recent quarter showed industrial demand in Victoria dropping 8%, the biggest quarterly fall in 25 years. Residential use? Down a staggering 28% year-on-year. Australians aren’t using less because they want to. They’re using less because they have to.

Meanwhile, production is faltering. National petroleum production hit a five-year low in Q1 2025, dropping 7% quarter-on-quarter. LNG shipments declined 7.3%. The party’s winding down. The recent ACCC report warns that southern states will need to increasingly rely on Queensland gas as their local reserves continue to deplete.

The outlook isn’t rosy either. There’s risk of a shortfall in Q4 2025 and throughout 2026 if Queensland LNG exports all uncontracted gas. The supply outlook has actually deteriorated since December 2024.

Labor’s plan focuses on directing uncontracted gas from LNG producers back to the domestic market. Will it work? Well, something better. Three times pre-export prices is three times too many for most Australians just trying to heat their homes and keep their businesses afloat. The dramatic coal generation decline from 70% to 53% of the energy mix shows the broader energy transition is well underway.

References

- https://www.oxfordenergy.org/wpcms/wp-content/uploads/2025/04/Comment-Australia-Gas.pdf

- https://www.accc.gov.au/media-release/deteriorating-short-term-outlook-for-east-coast-gas-supply

- https://ieefa.org/resources/slump-eastern-australia-gas-demand-shows-no-signs-easing

- https://australiainstitute.org.au/wp-content/uploads/2025/07/P1816-Gas-updates-gas-and-electricity-prices-WEB.pdf

- https://www.energyquest.com.au/energyquarterly-report-june-2025/

- https://www.aemo.com.au/-/media/files/gas/national_planning_and_forecasting/gsoo/2025/2025-gas-statement-of-opportunities.pdf

- https://www.elgas.com.au/elgas-knowledge-hub/business-lpg/australian-petroleum-statistics-2025-data-forecast/

- https://melbourneinstitute.unimelb.edu.au/news/news/2025/theres-more-to-high-cost-of-energy-than-the-green-transition