As climate change continues to impact the planet, Americans are paying a price that doesn’t appear on any tax form. This hidden climate tax works like a silent drain on our economy and family finances. Under some scenarios, it could reduce annual GDP by 10% by the end of this century.

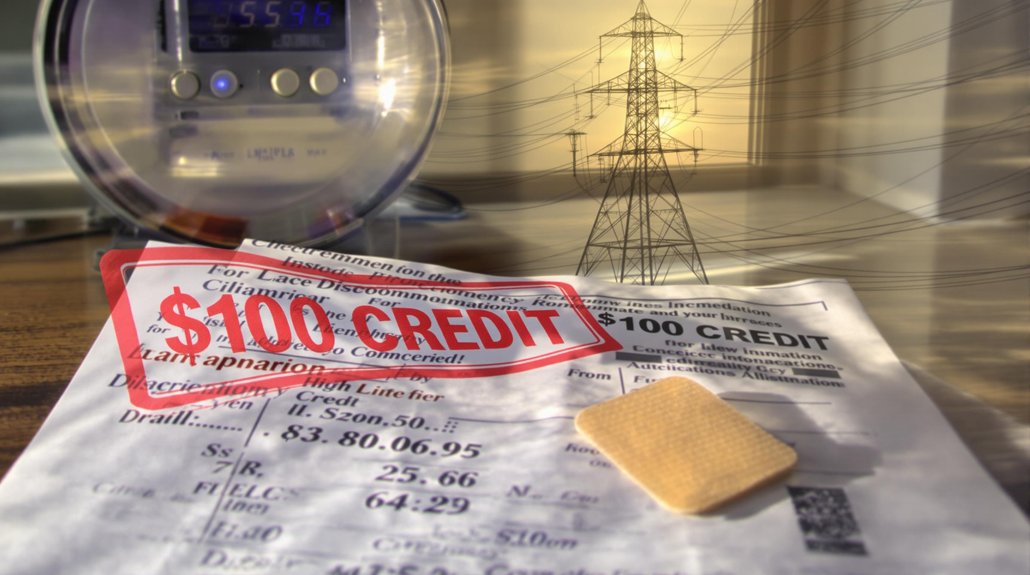

Experts estimate a $5.3 trillion annual “hidden carbon subsidy” exists globally. About one-quarter of this relates directly to CO2 emissions. Unlike regular taxes, climate costs hit people randomly, similar to a “reverse lottery” where some pay heavily while others temporarily escape the bill.

A hidden $5.3 trillion carbon subsidy functions like a reverse lottery—some pay heavily while others temporarily escape the climate bill.

Recent weather disasters show how these costs appear in real life. Hurricanes Florence and Michael caused billions in property losses along coastlines. California has seen nine of its ten largest wildfires in approximately the past 15 years, with three major fires in 2018 alone causing at least $9 billion in damages.

Many economists support carbon taxation to address these issues. A carbon tax of $190 per ton would add about $1 per gallon to gasoline prices. Elon Musk has frequently argued that a carbon tax is the only action needed to solve climate change, though this view oversimplifies the complex nature of climate solutions. The United States already regulates local environmental damages like sulfur dioxide, but carbon emissions remain largely unaddressed. The irony deepens as AI technology, which could help combat climate change, is simultaneously contributing to the problem with data center emissions projected to double by 2030.

The problem extends beyond direct carbon emissions. Tax havens create hidden environmental harm. For example, palm oil companies operating through the British Virgin Islands contribute to rainforest destruction in Indonesia. A study found approximately USD 18.4 billion in foreign capital was sourced from tax haven jurisdictions and transferred to environmentally destructive industries in the Brazilian Amazon. Special economic zones offer tax breaks that can enable harmful activities. About 5,000 such zones exist across more than 130 countries.

Current tax systems sometimes work against environmental justice. Flat taxes like sales tax don’t follow the “polluter pays” principle. Contract secrecy worsens tax abuse while hiding environmental impacts.

The lack of carbon taxation effectively creates a hidden subsidy for carbon-intensive activities. Climate legislation could help address the haphazard distribution of these costs. Without action, Americans will continue paying this invisible tax through property damage, economic losses, and declining quality of life as climate change intensifies.

References

- https://www.stockholmresilience.org/research/research-news/2018-08-13-the-hidden-environmental-consequences-of-tax-havens.html

- https://www.cato.org/blog/examining-elon-musks-claim-carbon-tax-simple-solution-climate-change

- https://taxjustice.net/wp-content/uploads/2024/06/How-corporate-tax-incentives-undermine-climate-justice-2024.pdf

- https://www.pinsentmasons.com/out-law/analysis/hidden-taxes-around-voluntary-carbon-credit-trading

- https://www.theregreview.org/2019/02/11/coglianese-nevitt-hidden-climate-tax/