While gas-guzzling vessels have dominated waterways for decades, a silent revolution is powering up across global harbors and lakes. Electric boats are surging from a $7.7 billion industry in 2025 to a projected $20.9 billion by 2035. Not too shabby for a market that many dismissed as a rich person’s toy just years ago.

The numbers don’t lie. With a 10.5% CAGR globally and the U.S. market alone expanding at a whopping 14%, electric boats are making waves. Literally. These battery-powered vessels are carving out significant market share in recreational boating, commercial ferries, and tourist boats. Mid-range power boats up to 500 kW currently dominate, perfect for those water taxis and day-tour operations where diesel engines used to belch fumes all over tourists’ Instagram photos.

Technology is finally catching up to the hype. Lithium-ion batteries have kicked lead-acid to the curb in most new designs. Battery sizes now range from modest 5 kW setups to monster 150 kW powerhouses. Fast-charging tech means owners aren’t stuck at the dock all day after a quick spin around the lake. Progress, people.

North America is flexing with nearly half the global market share, thanks partly to government incentives that make going electric less financially painful. Europe isn’t far behind at 40%, their strict emission regulations forcing innovation whether boatmakers like it or not. Meanwhile, Asia-Pacific shipyards are going all-in with an 18.7% growth rate that’s making everyone else nervous. This maritime transformation aligns with the global shift toward renewable energy sources that’s helping combat climate change through reduced emissions.

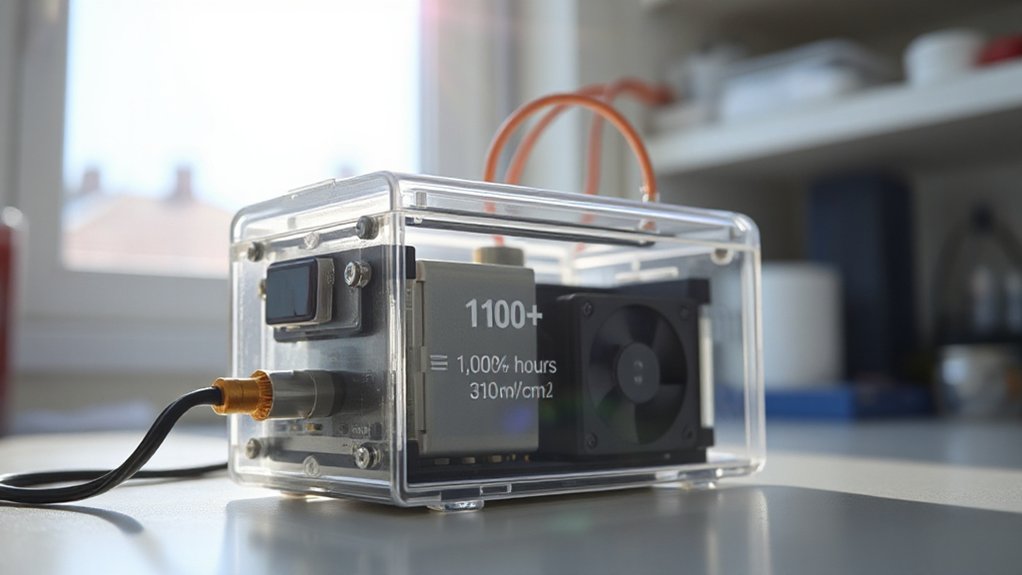

Pure electric boats make up most of the market, but don’t count out the hybrid systems that combine combustion engines with electric motors. The full electric segment maintains its dominance with 69.3% market share, particularly appealing to environmentally conscious boaters who value quiet operation and minimal maintenance requirements. They’re the compromise for the range-anxious boater who’s heard horror stories about being stranded when the battery dies. Electric motors deliver impressive maintenance advantages with service intervals of 10,000+ hours compared to diesel engines that need overhauls every 3,000-5,000 hours.

New builds represent about 68% of the market—turns out designing electric from scratch works better than slapping batteries on old hulls. Who knew?

References

- https://www.futuremarketinsights.com/reports/electric-boats-market

- https://www.grandviewresearch.com/industry-analysis/us-electric-boat-market-report

- https://market.us/report/electric-boat-market/

- https://www.mordorintelligence.com/industry-reports/electric-boat-and-ship-market

- https://www.globenewswire.com/news-release/2025/07/09/3112715/28124/en/Leisure-Boat-Market-Outlook-Report-2025-2034-Electric-Propulsion-AI-Driven-Maintenance-and-Green-Innovations-Fueling-Expansion.html

- https://boatingindustry.com/features/2025/08/26/market-trends-oems-continue-to-invest-as-electric-boating-gains-interest/

- https://salvagemarine.net/2025/01/boating-trends-for-2025/

- https://www.electrifiedmarina.com/electricboatsarethefuture