Louisiana’s LNG industry continues to grow with a fifth export terminal now in development. The state already handles 61% of America’s natural gas exports, shipping mainly to Europe and Asia. This new facility will create jobs, boost tax revenue, and strengthen the U.S. position as a global energy exporter. However, the expansion doesn’t come without challenges. Environmental concerns and regulatory hurdles remain significant factors in the state’s ambitious energy plans.

Louisiana is powering ahead as America’s leading liquefied natural gas (LNG) hub with major new projects breaking ground across the state. The addition of a fifth export terminal will further cement Louisiana‘s position as the nation’s LNG powerhouse. Currently, four active terminals make Louisiana the top LNG exporter in the United States.

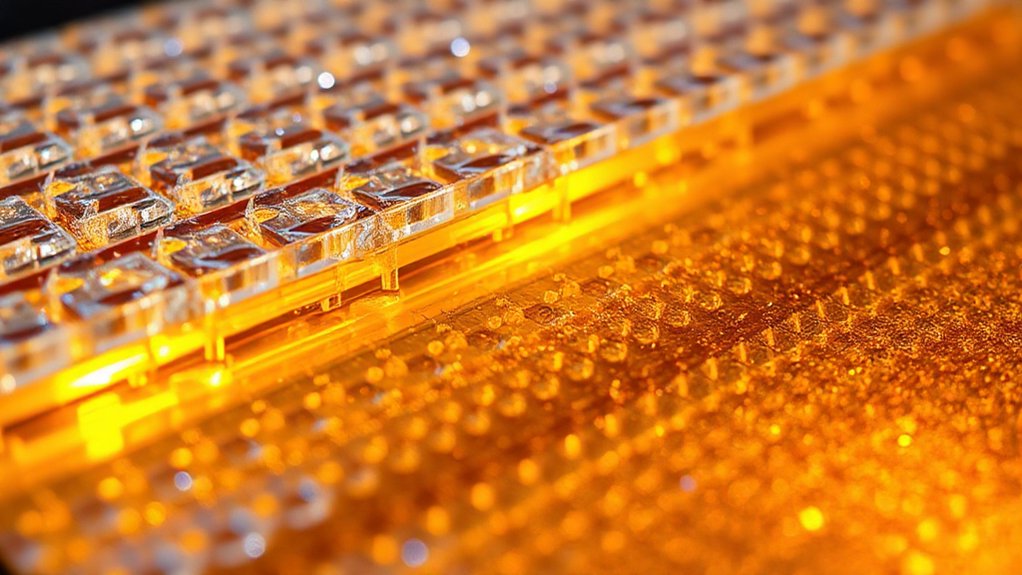

Woodside Energy’s Louisiana LNG represents a historic $17.5 billion investment in Calcasieu Parish. This project stands as the largest single foreign investment and greenfield development in Louisiana’s history. The new facility will include three production trains designed to produce 16.5 million tons of LNG per year.

Woodside’s $17.5 billion LNG project marks Louisiana’s largest foreign investment, with three trains producing 16.5 million tons annually.

The economic benefits are substantial for local communities. The LNG sector creates thousands of jobs in construction, operations, and support services. The project is expected to support approximately 15,000 jobs during the construction phase. Louisiana’s extensive 30,000-mile natural gas pipeline network provides the perfect foundation for these expanding operations. Local and state governments expect to collect significant tax revenues from these activities.

On the national stage, Louisiana handled 61% of total U.S. LNG exports in 2023. This dominant position has helped make the United States the world’s largest LNG exporter. The state’s terminals primarily supply gas to Europe and Asia, where demand continues to grow. These exports have strategic importance in reducing Russia’s influence over European energy markets.

The regulatory environment presents both challenges and opportunities. While federal and state authorities have approved multiple terminals, the Biden administration attempted to pause new export permits earlier this year. A federal judge blocked this action in July 2024, allowing development to continue.

Environmental concerns remain a significant issue. High-tech advanced monitoring systems are being deployed to address potential gas leaks and other emissions that could affect local ecosystems. Groups regularly challenge these projects over emissions, habitat disruption, and coastal impacts. Companies like Woodside emphasize sustainable practices in response to these concerns.

Despite these challenges, Louisiana’s “all of the above” energy strategy continues to attract investment. With Venture Global’s Plaquemines LNG terminal and Woodside’s Louisiana LNG each set to add over 3.7 Bcfd capacity, the state’s LNG empire shows no signs of slowing down.

References

- https://www.ferc.gov/media/us-lng-export-terminals-existing-approved-not-yet-built-and-proposed

- https://www.asap.nl/lng-terminals-over-the-world-complete-list-and-map-2025/

- https://neworleanscitybusiness.com/blog/2025/05/02/woodside-louisiana-lng-terminal-investment/

- https://www.workboat.com/government/louisiana-lng-terminal-gets-green-light-from-energy-secretary

- https://www.wwno.org/coastal-desk/2025-04-30/australian-company-commits-to-17-5b-lng-export-terminal-in-louisiana