While Wall Street‘s biggest money managers typically make headlines for their investment success, they’re now in the spotlight for different reasons. BlackRock, Vanguard, and State Street are facing a major lawsuit from Texas and 10 other Republican-led states. The legal battle, which began in late 2024, accuses these financial giants of working together to hurt the coal industry.

Texas Attorney General Ken Paxton claims these companies formed an investment cartel to control the coal market. The lawsuit says they used their power as major shareholders to pressure coal companies to cut production in half by 2030. This allegedly drove up electricity prices for Americans across the country.

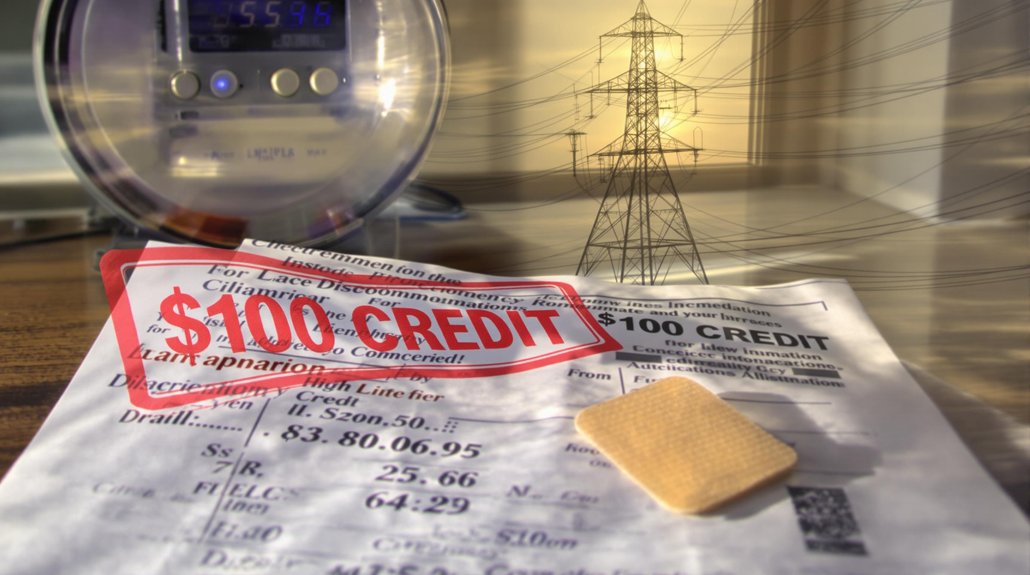

Financial giants weaponized their shareholder power to squeeze coal producers and inflate Americans’ electricity bills.

The case centers on whether these asset managers broke antitrust laws while pursuing environmental goals. The states claim the companies shared sensitive information and coordinated their efforts to enforce compliance among coal firms. This allegedly created artificial shortages and higher prices.

In May 2025, a federal judge allowed most of the lawsuit to move forward, rejecting the companies’ attempts to have it dismissed. The U.S. Department of Justice and Federal Trade Commission have backed the states’ position, expressing concern about potential market manipulation.

The asset managers have strongly denied these claims. BlackRock called the lawsuit theory “absurd,” while Vanguard expressed disappointment with the court’s decision. State Street labeled the allegations “baseless and without merit.” All three companies insist their investment practices are legal.

If successful, the lawsuit could impact around $18 billion in coal-related holdings. Critics argue these companies’ actions have made it harder for coal businesses to raise money and support jobs, threatening American energy independence. Proponents of renewable energy counter that the transition away from coal is necessary for greenhouse gas reduction and combating climate change.

The case highlights growing tensions between environmental investing goals and traditional market competition. It also raises questions about how much influence large asset managers should have over the companies they invest in, especially when pursuing climate-related objectives. Judge Jeremy Kernodle noted that while the claims are specific and not vague, the states may still struggle to prove that stock ownership induced coal output reduction.

Former Energy Secretary Rick Perry has criticized the lawsuit as being misguided and potentially undermining broader energy policy goals.

References

- https://www.esgtoday.com/texas-judge-greenlights-multi-state-lawsuit-accusing-blackrock-vanguard-state-street-of-using-esg-investing-initiatives-to-manipulate-energy-markets/

- https://www.texasattorneygeneral.gov/news/releases/attorney-general-ken-paxton-scores-major-win-hold-blackrock-state-street-and-vanguard-accountable

- https://www.foxbusiness.com/politics/rick-perry-says-ken-paxtons-energy-lawsuit-hurt-us-coal-companies

- https://www.psca.org/news/psca-news/2025/5/ftc-doj-file-brief-in-coal-anti-trust-case-against-asset-managers/

- https://www.esgdive.com/news/blackrock-vanguard-state-street-motion-to-dismiss-coal-antitrust-case-denied-texas-ag/757336/