America’s power grid received a D+ grade from civil engineers, indicating it’s “poor” and “at risk.” This marks a decline from its previous C- rating. Over half the U.S. grid faces potential energy shortfalls within the next decade as demand rises and existing generation retires. Extreme weather, which caused 80% of power outages since 2000, continues to expose infrastructure weaknesses. The $578 billion investment gap presents substantial challenges ahead.

The fragility of America’s aging power grid has experts sounding alarms nationwide. In its latest report card, the American Society of Civil Engineers (ASCE) gave U.S. energy infrastructure a D+ grade, indicating conditions are “poor” and “at risk.” This marks a decline from the previous C- grade, reflecting growing concerns about safety and capacity issues across the country’s electrical systems.

The North American Electric Reliability Corporation (NERC) warns that over half of the U.S. grid could face energy shortfalls within the next decade. Peak summer demand is expected to rise by 122 gigawatts in that time, while up to 115 gigawatts of existing generation could retire by 2034. These trends point to a widening gap between supply and demand.

Weather-related disruptions are becoming more frequent. Since 2000, extreme weather has caused 80% of U.S. power outages. The last decade (2014-2023) saw twice as many weather-related outages compared to the 2000-2009 period, highlighting the grid’s vulnerability to climate change. These weather events resulted in property damage costs of $182 billion in 2024 alone.

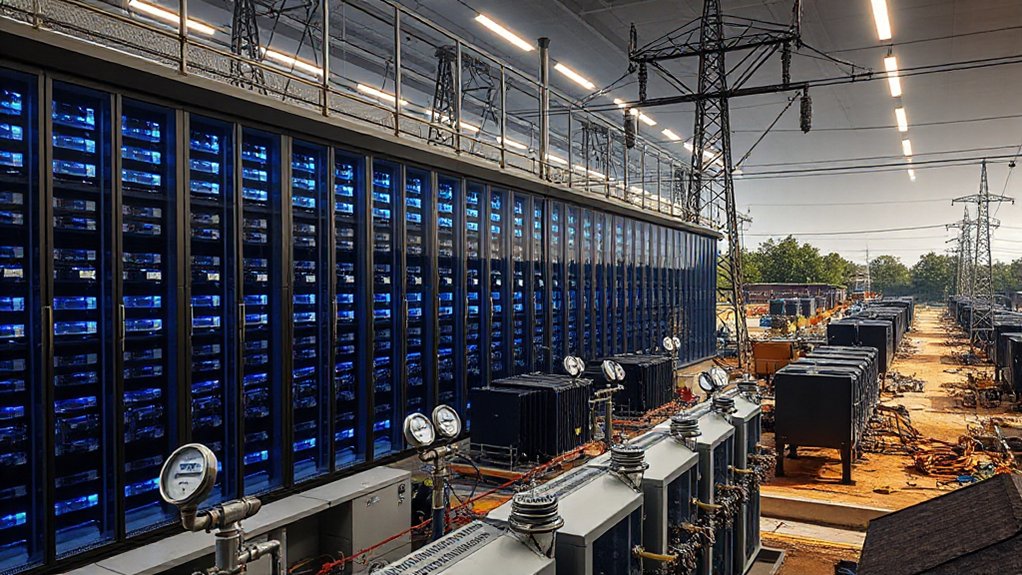

At the same time, demand for electricity is surging. Forecasts show a 9% increase by 2028 and 18% by 2033. Data centers alone could account for 44% of load growth through 2028. Combined with electric vehicles, these technologies will require 35 gigawatts by 2030, doubling their current demand.

The investment needed is staggering. Experts identify a $578 billion gap for energy infrastructure alone, part of a $3.7 trillion overall infrastructure shortfall. For energy generation and delivery systems, $1.89 trillion in investment is required over the next decade. The transition to clean energy sources will require substantial grid upgrades to accommodate the influx of renewable energy systems.

Federal efforts are underway to address these challenges. The Infrastructure Investment and Jobs Act provided $550 billion in new funding, while the Inflation Reduction Act allocated $30 billion for clean energy projects. Last year, utilities spent $27.7 billion on transmission and $50.9 billion on distribution infrastructure. NERC has expressed particular concerns about natural gas supply during extreme weather events, especially in regions with high electricity production.

As the energy landscape evolves, 63 gigawatts of new utility-scale capacity is expected in 2025, with solar and battery storage leading the way at 81% of planned additions. However, regulatory hurdles continue to slow progress on critical transmission projects needed to strengthen America’s power grid.